Nvidia: What future holds for it?

Company Overview

- Founded: 1993

- Headquarters: Santa Clara, California, United States

- Revenue (LTM): $26,914 million

- Operations: The company operates mainly in two segments – graphics and computing and networking

- Product Offerings: Graphic processing units and software. Eg. NVIDIA RTX GPUs and Mellanox networking and interconnect solutions

NVDA Analysis

Nvidia pioneered Graphic Processing Units (GPUs) to make video games more realistic and improve the gaming experience for the wide community of gamers. It is also expanding into the areas of automotive and software. Nvidia is the top designer of discrete GPUs that enhance the visual experience on computing platforms. In fact, it has experienced success in focusing its GPUs on nascent markets such as AI and self – driving vehicles. Hyperscale cloud vendors have also leveraged GPUs for uses such as image processing and speech recognition.

The gaming industry is the linchpin of Nvidia’s current business, as PC gaming enthusiasts generally purchase high-end discrete GPUs offered by the likes of Nvidia and AMD. There is an expectation for the data center segment to drive most of the firm’s growth, which is led by the explosive AI phenomenon. In fact, AI technology has proven to be a significant revolutionary element of the current digital era. The global AI market size is valued at USD 62.35 billion in 2020 and is expected to expand at a CAGR of 40.2% from 2021 to 2028. Nvidia, is expected to ride this wave of growth.

Nvidia started trading at around $59 per share in 2020 but gained around 275% in over two years with a price of $221 today. This huge jump can be attributed to the accelerated adoption of artificial intelligence and the mandatory move to the digital world because of the pandemic. The jump could also be due to the multiple expansions that Nvidia is planning or working on.

Financials

Nvidia share price has been increasing over the last twelve months and it peaked in November/December period before coming down amid the FED tapering of bond buying program, rate hikes and lastly, the reduction of balance sheet. Despite the correction, we can see that Nvidia is fundamentally sound as shown by revenue growth, gross and EBITDA margin when compared to its comparable. However, it can be argued that it is still overvalued as shown by the P/E, P/B and EV/EBITDA multiple.

According to the IBD composite ratings, Nvidia does earn a superior rating of 91, which means that it has outperformed 91% of all the other stocks in terms of combined technical and fundamental metrics. In the 4th Quarter of FY22, Nvidia earnings rose 69% while sales climbed 53% and they have easily beaten the Q4 earnings and sales expectations. Q4 gaming chip revenue jumped 37% while Data Center chip sales soared 71%. Moreover, Nvidia guided revenue higher for the current quarter, while Chief Executive Jensen Huang cited that there has been “exceptional demand” for Nvidia chips.

Where now?

I believe that there is still room to grow for Nvidia, and that it will rise even higher. According to FactSet, out of 46 analysts covering NVDA, 36 rate it a buy, 8 have a hold while 2 have a sell. Majority of the analysts do believe Nvidia can keep beating expectations and that it has solid fundamentals to begin with. The reasons that caused me to believe Nvidia will keep rising are,

1. Increased long term demand in chips

Most tech-related industries are heavily dependent on chips, such as the gaming industry and the automotive sector. As the world adopts the Metaverse, there will also be an increase in demand for chips. Nvidia chips are also used for Bitcoin mining. With an increased demand for chips in most tech-related industries, such as computers and phones, coupled with the booming AI, crypto and cloud gaming sectors, Nvidia’s revenue is expected to grow quickly and steadily. This increased long term demand for chips is exacerbated by a current shortage of chips that is expected to last until 2023. As the Russia – Ukraine conflict unfolds, this will affect the supply chain in many ways, one being the transportation routes for the chips. Certain transportation route can be blocked hence, prolonging the shipping of these ships, causing a delay in transportation.

2. Positioned to stay ahead of competitors

Nvidia is the market leader in the GPU space with an 81% market share. Not only that, Nvidia is also the leading supplier for self-driving cars and data centers. For example, it will supply the chip that acts as the “brain” for the Nio (NIO) ET7, which will be a highly autonomous electric vehicle when it arrives this quarter. And Nvidia already supplies Amazon (AMZN) Web Services with chips for data centers. Nvidia’s GPUs act as accelerators for central processing units, or CPUs, made by other companies. In April 2021, Nvidia unveiled its first CPU, called Grace, which uses chip designs from the U.K.-based Arm for high-end computing. With its own CPU, Nvidia will offer a more complete system for data centers, directly challenging processor giants Intel (INTC) and Advanced Micro Devices (AMD). While Nvidia has advantages in GPU market, it has no CPU of their own and this move to produce its own CPU will enable it to compete with its competitors such as Intel and AMD, whom are advancing themselves down the Accelerated Processing Unit (APU) path – a single chip that combines both CPU and GPU. Therefore, the creation of Grace will allow Nvidia to create a powerful GPU and CPU package to compete with AMD’s Ryzen and Radeon, as well as Intel’s i-Series and Arc.

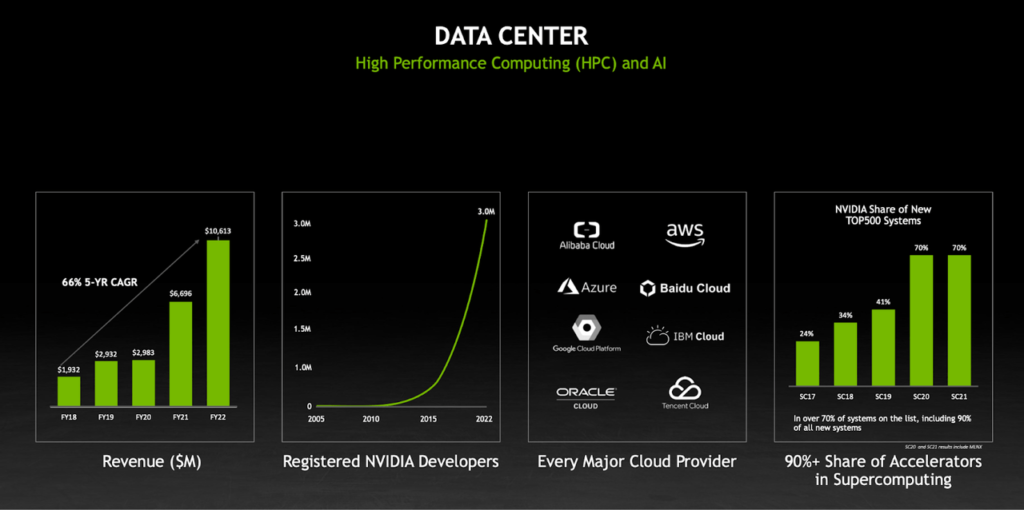

Nvidia has also quickly become the dominant supplier for the data center industry, with substantially most systems using its components. It has recorded a 66% 5-Yr CAGR for the Data Center sector from FY18 to FY22, which is a huge jump and it is expected to continue this growth in the future as the world becomes more digitalized.

3. Innovations and Partnership

Nvidia has been innovating to keep their lead in the semiconductor industry. It has been producing the gaming chips that continuously improves every year providing a seamless gaming experience for the gamers. Now, it has also entered the software industry through its Omniverse software. With Omniverse, Nvidia’s real-time 3D design collaboration and virtual world simulation platform, artists, designers and creators can use leading design applications to create 3D assets and scenes from their laptop or workstation. In January 2022 at CES, has just made its Omniverse software available to creators who use its graphics processors. The company also revealed a lower-priced GeForce RTX graphics processor to spur gamers to upgrade to ray-tracing technology. This allows Nvidia to capture a larger percentage of the market share. The Nvidia Omniverse is also a ticket to access the Metaverse because it provides the “plumbing” on which metaverses can be built – Nvidia’s chip and computing power are the key to the emerging metaverse. Such an innovation can only accelerate Nvidia’s growth. Another partnership is the partnership with Google cloud to establish the industry’s first AI-on-5g innovation Lab, which would increase Nvidia’s dominance in the AI industry. This partnership will accelerate Nvidia’s growth in the technology industry. As data centers are becoming a huge driver in Nvidia’s revenue, Nvidia has also partnered with the top Cloud Providers in the world and this is a great signal to every investor that Nvidia, is here to stay in the cloud and data center sector. All these partnerships and innovations are signaling that we should stay invested in Nvidia in my opinion.

In conclusion, I do see Nvidia rising in the future because it has a lot of potential and room to grow in the new field of Artificial Intelligence. It has also displayed its capabilities in innovating, building relationships with different companies and eventually leveraging on these partnerships to establish itself as a key player in the semiconductor industry.

I encourage you to view the investor presentation of Nvidia to see what to expect from them in the coming year as well as a review of their performance for the past few months. Take a look here.

Sources:

https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-ai-market

https://seekingalpha.com/article/4492525-nvidia-stock-rebound-300-levels-2022

https://www.investors.com/research/nvidia-stock-buy-now/

https://sg.finance.yahoo.com/quote/NVDA/history?p=NVDA

https://developer.nvidia.com/nvidia-omniverse-platform

https://www.dragonfly.hk/caffeinated/mar8-2022-arms-fate-after-nvidias-40b-deal-collapsed

Pitchbook, Capital IQ