The buzzword: Inflation!

What is inflation?

According to Investopedia, inflation is the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period of time. The rise in the general level of prices often expressed as a percentage, means that a unit of currency effectively buys less than it did in prior periods. In the US, there are 2 primary sources of inflation data – the Quarterly GDP Report and the Monthly Consumer Price Index (CPI). The Quarterly GDP Report contains the thoroughly researched GDP price deflator which is the most authoritative number as it is based on the whole economy and is used extensively by policymakers. The Monthly Consumer Price Index (CPI) is based on a representative basket of goods and services such as food, housing and automobile. For CPI to be an effective measure of inflation, it needs to be truly representative of spending habits in that particular country.

Inflation is commonly classified as either Cost-Push Inflation, Demand-Pull or Built-In Inflation and the most commonly used inflation indexes are the Consumer Price Index (CPI) and the Wholesale Price Index (WPI). Take a look at the videos below!

Types of Inflation

As the currency loses its value, prices rise and it buys fewer goods and services. This is a loss of purchasing power which impacts the general cost of living for the common public and leads to deceleration in economic growth. As mentioned earlier, there are commonly 3 different types of inflation.

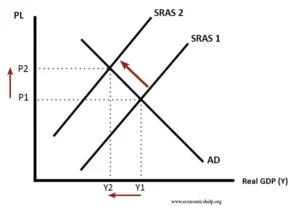

1) Cost-Push Inflation

Cost-Push Inflation happens when overall prices rise due to increases in the cost of wages and raw materials. It can occur when higher costs of production decrease the aggregate supply or the total amount of production in the economy. Since the demand remains constant hasn’t changed, the price increases from production are passed onto consumers creating cost-push inflation.

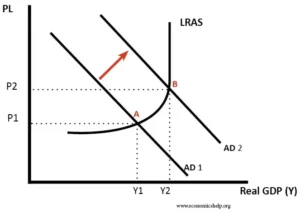

2) Demand-Pull Inflation

Demand-Pull inflation occurs when an increase in the supply of money and credit stimulates overall demand for goods and services to increase more rapidly than the economy’s production capacity. The aggregate demand grows rapidly and rises faster than the productive capacity. Demand-pull inflation is the upward pressure on prices that follows a shortage in supply, a condition that economists describe as “too many dollars chasing too few goods.”

3) Built-In Inflation

Built-in inflation is related to adaptive expectations. It is the idea that people expect current inflation rates to continue in the future. When the price of goods and services rises, workers and others come to expect that they will continue to rise in the future at a similar rate and demand more costs or wages to maintain their standard of living. Their increased wages result in a higher cost of goods and services, and this wage-price spiral continues as one factor induces the other and vice-versa.

Causes of Inflation

Inflation is a monetary phenomenon in which too much money chases too few goods. An expansive money supply will see inflation as the result. However, there are other forces that can cause inflation too

1) Structural Changes: During a structural change in the economy such as a shift from manufacturing to a service economy or from one that is domestically focused to one that is export and trade-oriented. Such a structural change can create periods where inflation stays subdued in the event of monetary expansion

2) Consumer/Investor Behaviour: Consumers are the wild card in this process as the changes in behaviour and demographics can affect inflation. For instance, as consumers age and/or starts to save more, relative to the past, you can see decreases in inflation or even deflation in economies.

3) Economic Slack: When an economy has employment and production slack such as after recessions or economic crises, inflation is normally subdued, even in the presence of fiscal and monetary stimuli, as it grows back to full capacity. This is the rationale that Keynesians would adopt to argue that central bankers need to ease monetary policy, in the face of economic slowdowns.

4) Size of the economy: Larger economies with currencies that are used globally have the capacity to absorb monetary stimuli that would put a lesser economy into an inflationary spiral. Hence, the EU and the US have more degrees of freedom to set monetary policy than does Brazil or Chile.

Inflation and Fixed Income

After the brief and concise explanation of the mechanics of inflation, it is time to understand how inflation affects the various asset classes starting with fixed income.

Fixed income broadly refers to those types of investment security that pay investors fixed interest or dividend payments until their maturity date. At maturity, investors are repaid the principal amount they had invested. Fixed-income security is affected by expected and unexpected inflation.

- Expected Inflation: When the bond contract is initiated, the buyer of a bond takes into account the expected inflation, at that time, when deciding the coupon rate for the bond. So, if expected inflation is 5%, a rational investor will demand a higher interest rate than when expected inflation is 3%.

- Unexpected inflation: After the contract has been created and issued, the investor and seller are exposed to the actual inflation which can be higher or lower than the expected inflation compared to when the bond was issued. The difference between the actual and expected inflation is called unexpected inflation. If actual inflation is lower than expected inflation, the bond interest rate will drop and the bond price will increase. Alternatively, if actual inflation is higher than expected, interest rates will rise and the bond price will decrease.

Inflation and Equities

- Interest rates: This is the most direct link between inflation and equity value. The risk-free rate (interest rate) forms the base for the expected returns that investors demand investing in a company’s equity as well as for lending it money. Hence, if inflation rises and is higher than expected, interest rates will also rise which will then push up the returns that the investors (both equity and lenders) demand.

- Risk Premiums and Failure Risk: By itself, inflation has no direct effect on equity risk premiums. However, it remains true that higher levels of inflation are associated with more uncertainty about future inflation. Consequently, as inflation increases, equity risk premiums will tend to increase. The effect of higher-than-expected inflation on default spreads is more intuitive. Interest expenses will be higher when inflation rises, and interest rates go up, and those larger interest expenses may create a higher risk of default.

- Revenue Growth Rates: As inflation rises, all companies will have more freedom to raise prices, but companies with pricing power, coming from stronger competitive positions, will be able to do so more easily than companies without that pricing power, operating in businesses where customers are resistant to price increases. As such, when inflation rises, the former will be able to raise prices more than the inflation rate, while price rises will lag inflation for the latter group.

- Taxes: The tax code is commonly written in nominal terms, and when inflation rises, the effective tax rate paid by companies can change. To see why, consider one aspect of the tax code, where companies are allowed to depreciate their investments in building and equipment over time, but only based upon what was originally invested in those assets. As inflation rises, the tax benefits from this depreciation will decrease, effectively raising the tax rate.

- Operating Margins: If revenues and costs both rise at the inflation rate, margins should be unaffected by changes in inflation, but this is not happening in the world most of the time. For companies that have costs that are sensitive to higher inflation and revenues that are less so, margins will decrease as inflation rises. Conversely, for companies where costs are slow to adjust to inflation, revenues that can quickly, margins will increase as inflation rises.

Inflation and Markets

In a recent couple of months, most of the news surrounding the markets is about inflation. Inflation numbers have been coming high but for much of the early part of 2021, a lot of the bankers, investors and politicians seemed to be dismissive of its potential damage. It is not until November 2021 that Powell opened the doors to accelerating the end of open market purchases of mortgage back securities and US Treasuries. In January 2022, Federal Reserve Chairman Jerome Powell then roll out measures to control inflation even after declaring that the US economy is healthy.

High inflation is not going away. In fact, prices have been going up their fastest since the early 1980s. According to the CPI, prices rose 7.9% in February compared to last year and this is the biggest annualized growth in CPI inflation since January 1982. Hence, a wave of actions was made during the 2-day meeting on March 15 and 16. The Federal Open Market Committee (FOMC) concluded by raising the federal funds rate target by 25 basis points, to a range of 0.25% to 0.50%. This is the first Fed rate hike since the end of 2018. This comes as no surprise since Powell had made it clear that the four-decade highs in US inflation rates made tighter monetary policy an absolute necessity and this is supported by the massive gains in the labour market recovery.

It is worth noting that this rate hike arrives at a moment of massive geopolitical uncertainty where Russia’s invasion of Ukraine has destabilised the commodity markets and caused the price of oil to soar (natural gas prices reach record highs). This is also the first of the several rate hikes expected throughout the rest of 2022 and the FED faces a daunting task of curbing inflation but not so much as to cause a recession. The yield on the 10-year US Treasury note rose on Friday (25th March) as much as 0.14 percentage points to 2.5 per cent, the highest level since May 2019, as the benchmark debt security fell in price. The Treasury market, which underpins the costs of corporate debt and consumer borrowing worldwide, is enduring its worst month since the election of Donald Trump in 2016. According to CME Group’s FedWatch Tool, there’s roughly a one-third chance the federal funds rate target range will rise to 1.75% to 2.00% by the end of 2022. There are roughly the same odds that the target rate will hit 2.00% to 2.25% by the end of the year. This suggests that the Fed could raise rates seven to eight times this year.

There is also the winding down of the humongous balance sheet which is another risky job. The scale of the job that the FED is attempting to do has never been attempted and thus, markets are worried that taking that much liquidity out of the system will weaken demand for stocks. The FED is not the only central bank cutting its balance sheet this year. According to Bank of America Global Research:

- The Fed will cut its balance sheet as a percentage of gross domestic product (GDP) from 36% to 31% by the end of 2022.

- The European Central Bank (ECB) will cut its balance sheet as a percentage of GDP from 69% to 58% by the end of the year.

- The Bank of England (BOE) will reduce its balance sheet from 44% to 42% of GDP.

Sources:

https://www.economicshelp.org/blog/2006/economics/cost-push-inflation-2/

https://aswathdamodaran.blogspot.com/2022/01/data-update-3-inflation-and-its-ripple.html

https://aswathdamodaran.blogspot.com/2021/05/inflation-and-investing-false-alarm-or.html

https://www.investopedia.com/terms/i/inflation.asp

https://www.theguardian.com/business/live/2022/mar/02/oil-price-blasts-111-opec-meeting-sberbank-european-arm-closed-business-live

https://www.forbes.com/advisor/investing/fomc-meeting-federal-reserve/

https://sg.news.yahoo.com/fed-chairman-jerome-powell-retires-the-word-transitory-in-describing-inflation-162510896.html

https://www.economicshelp.org/blog/27613/inflation/demand-pull-inflation/